AWS Still On-Track to be #1 Enterprise Storage Vendor in 2020

No one has ever published estimates of how much revenue the cloud service providers derive from storage, and where that places them in the rankings of storage leaders. So last August, IT Brand Pulse published a LinkedIn article that tied together various sources of data to conclude that AWS was the #3 enterprise storage vendor in 2017 and would emerge as #1 by 2020.

The following is our updated estimates for AWS’s ranking on the enterprise storage leaderboard in 2018. The bottom line is we estimate AWS repeated as the #3 enterprise storage vendor by revenue, and reconfirm that AWS will be #1 in 2020.

Read on to see how we calculated our results.

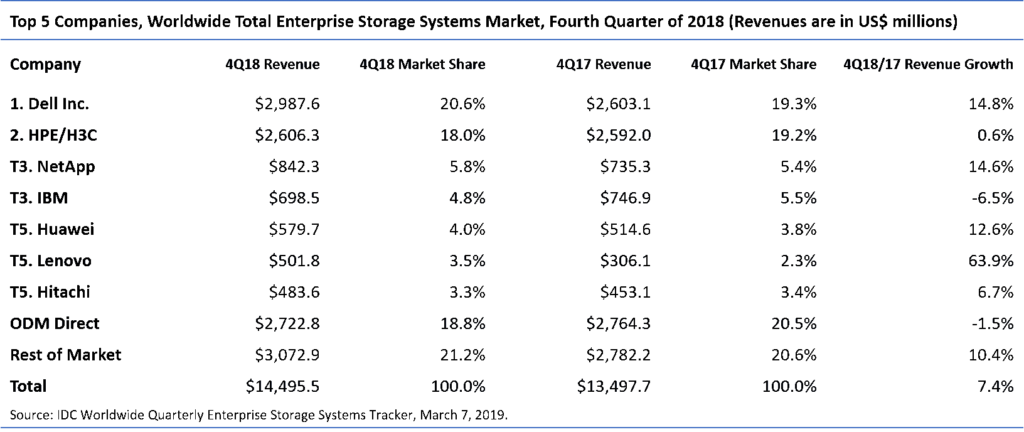

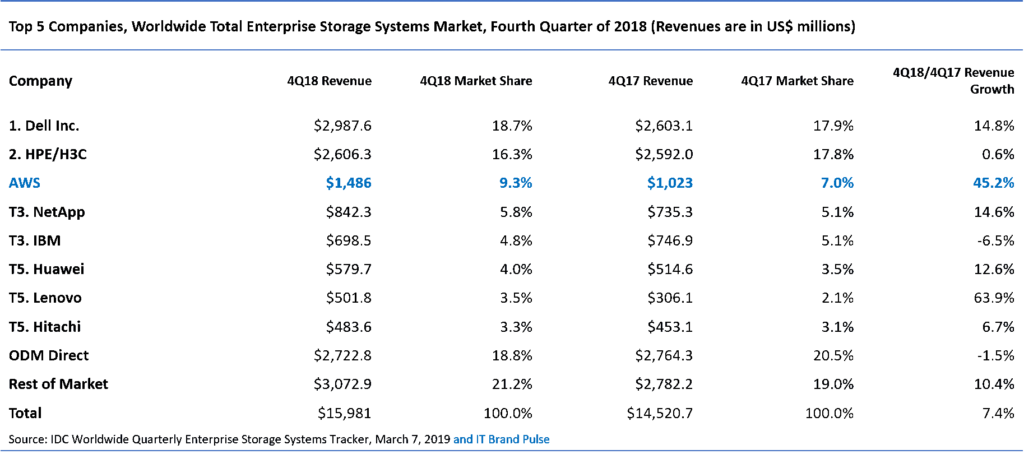

Growth in Q4 for Traditional Storage Leaders

Data from IDC defines the rankings of storage system leaders rankings. These are the storage systems you find in every data center that are being displaced a little every year by Storage-as-as-Service (STaaS). After years of slow growth, some traditional storage leaders enjoyed healthy growth in Q4 2018.

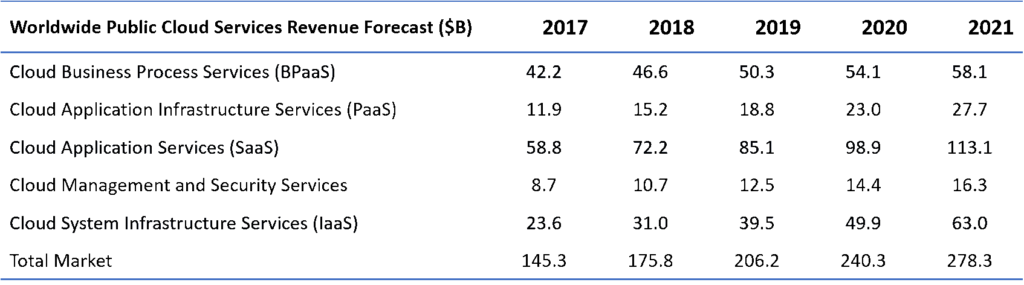

Led by IaaS, Cloud Services Revenue is Booming

We then searched for data about Cloud Services Revenue. According to Gartner, cloud services revenue is booming with the highest growth rate in the IaaS sector. We still need to determine the size of the STaaS market, which is a subset of these IaaS projections, but this Gartner forecast defined a 2017-2021 growth rate that we can use for STaaS.

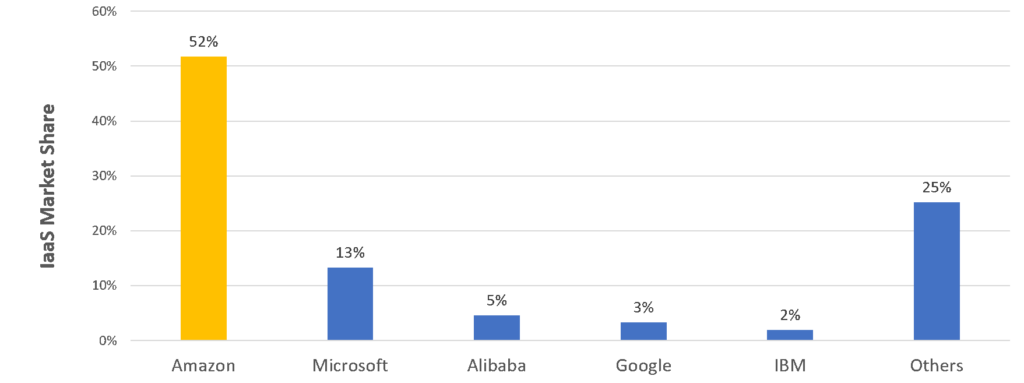

AWS Dominates IaaS Market Share

In late 2018 Gartner published rankings for overall IaaS revenue market share which we used to extrapolate STaaS market share. According to Gartner, AWS owns over half the IaaS market, and we believe it is reasonable to assume AWS has similar market share for STaaS.

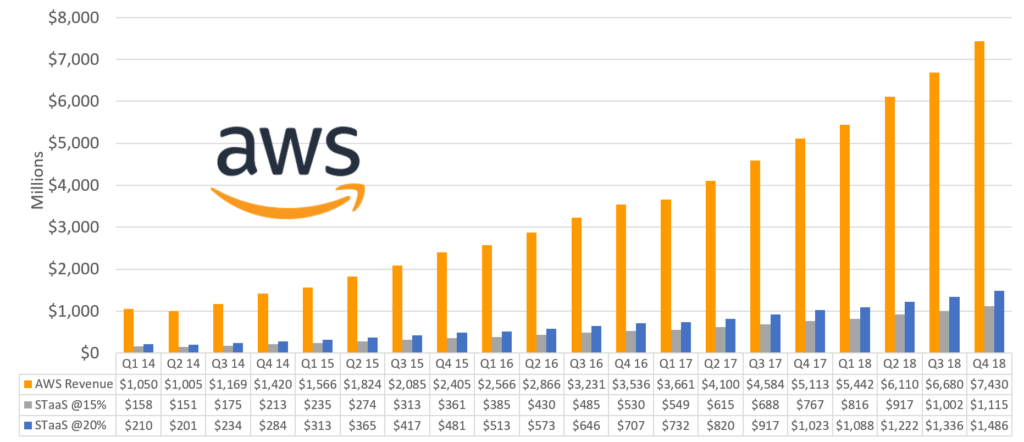

$1.1B to $1.46B STaaS Revenue for AWS in Q4 18

IT Brand Pulse estimates that AWS storage revenue is between 15 and 20% of overall revenue. On the following slides are actual AWS revenue numbers published by Amazon along with numbers for AWS storage revenue at 15% of overall revenue and 20% of overall revenue.

Based on the revenue reported by Amazon for Q4 2018 and our estimates, AWS storage revenue was between $1.1 billion and $1.486 billion in Q2. That is an annual storage run-rate of $4.4 to $5.944 billion…and growing rapidly.

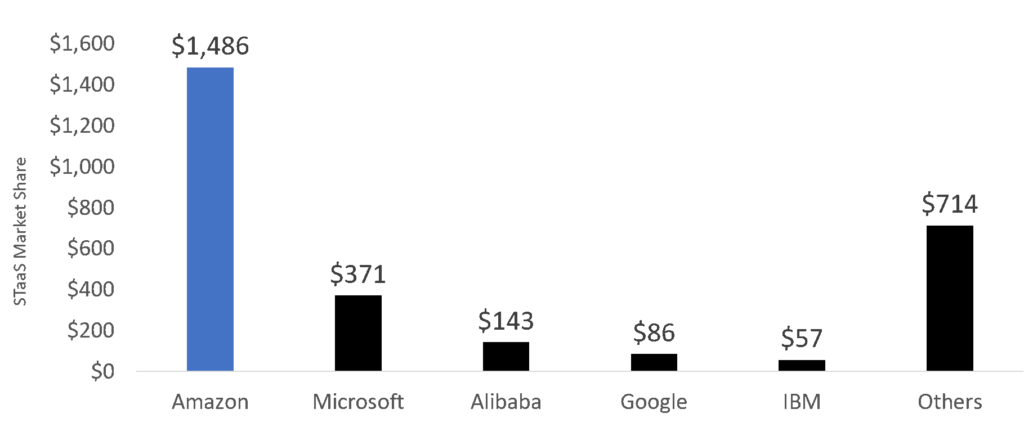

AWS STaaS Revenue Market Share in Q4 18

Combine the Gartner IaaS market share estimates with our estimate that up to 20% of IaaS revenue comes from storage, and you get a Q4 STaaS TAM of $2,587B. The following chart showing STaaS revenue and rankings for Q4 18.

AWS Repeats as #3 Enterprise Storage Vendor in 2018

Below we put the estimated AWS Q4 storage revenue of $1.1 to $1.46 billion into the IDC storage rankings shown above and “Voila!” you see that AWS is again a solid #3 in enterprise storage revenue. The gaudy AWS growth rate stands out and provides a strong hint that we should not expect AWS to stay at #3 for long.

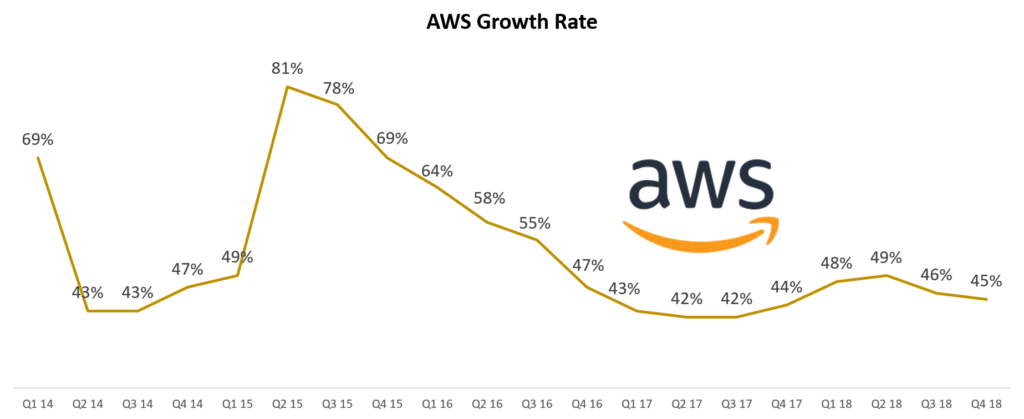

AWS Can Sustain Their Growth Rate. Here’s Why.

AWS raced to a third place rankings by riding the massive IaaS wave the last several years. We searched for ways to validate the Gartner growth trajectory, and found data about their history of growth and about their investment in R&D.

While not growing at 80% per year anymore, AWS is seeing steady growth above 40% the last several quarters. This gives us confidence we can count on another year or two of over 40% per year growth.

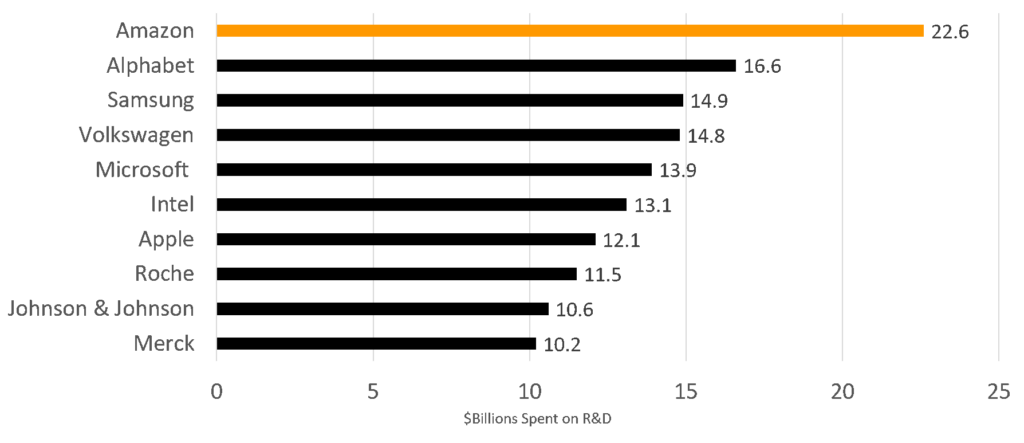

The 2017 World R&D Leader

If R&D investment is the key to sustaining over 40% per year growth, then you can bet the farm because no one, I mean no one, invests more in R&D than Amazon. According to Bloomberg, Amazon spent over $22 billion on R&D in 2017, 36% more than Google, and 62% more than Microsoft.

AWS #1 Enterprise Storage Vendor in 2020

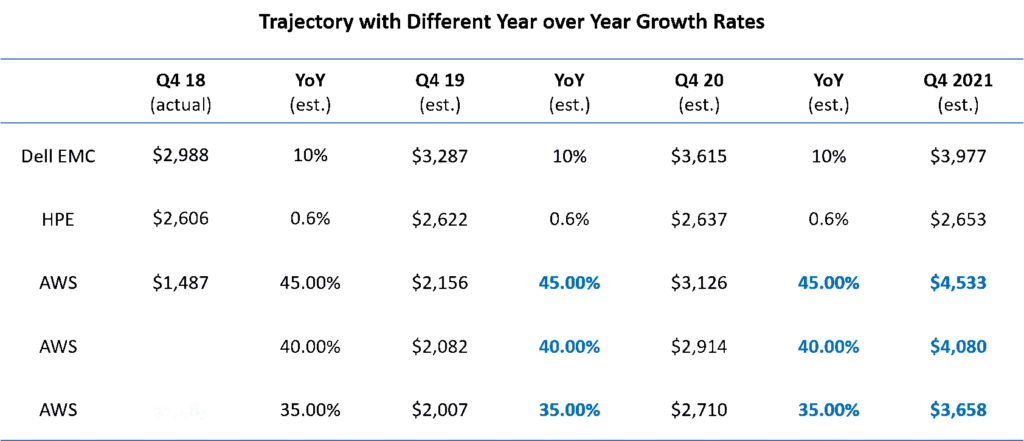

In the model below, we estimated that the growth rate for Dell storage would be strong through 2021, HPE would see almost zero growth as in 2018, and AWS would enjoy from 35% to 45% annual growth.

Only if Dell EMC growth remains at 10% and AWS growth decelerates to 35% per year, does Dell remain #1.

It is more likely that AWS will race past the pack in 2020 while sustaining with 40% growth and driving over $15 billion in annual storage revenue.

Your Feedback is Appreciated

If you have information that can make these estimates more accurate, we welcome your feedback and will publish updates if we get data that significantly changes this analysis.